Tax Fraud days of Action 2025

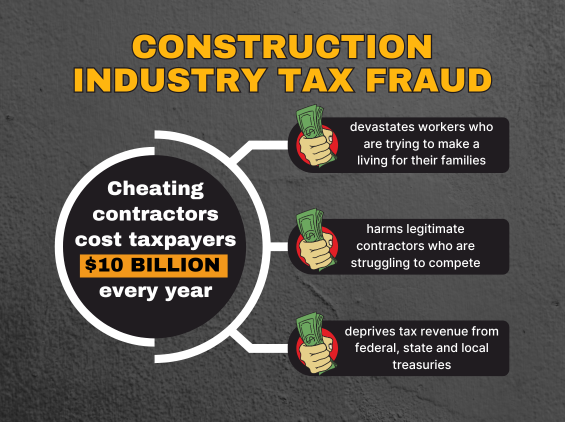

Tax fraud is no accident. Cheating contractors use underhanded schemes to evade their obligations. They fail to deduct and pay employment-related federal and state taxes to the tune of $10 billion a year.

A growing number of construction contractors are tax cheats. They pay their employees off the books or wrongly classify them as independent contractors. It’s intentional. Many use labor brokers and operate in the dark shadows of the underground economy.

The tax funds that are lost could be used to build schools, improve roads, fund police and fire departments, and help veterans.

The Century Foundation, in partnership with the United Brotherhood of Carpenters has released a study about misclassification in the construction industry and the numbers are not good.

Using national and state-by-state data, the study shows that in the seven states where the North Atlantic States Regional Council of Carpenters operates, an estimated 230,000 construction workers are illegally misclassified, the cost to taxpayers is more than $1.16 billion and the savings to contractors who cheat is $1.8 billion.

“The construction industry is awash in worker misclassification, a practice that hurts workers, honest employers, and local governments alike,” said Century Foundation Fellow and co-author of the report Laura Valle-Gutierrez. “Misclassification denies construction workers their legal rights and shortchanges these workers by $12 billion a year in lost wages and benefits nationwide. Misclassification also puts law-abiding employers at a significant cost disadvantage and amounts to tax fraud by corporations that skirt the law.”

A report by the University of California Berkeley Labor Center revealed that 39 percent of construction worker families nationwide are forced to enroll in one or more safety net programs to make ends meet. That is higher than the 31 percent of all workers enrolled in such programs.